Instead of increasing, the tax on palm oil will go down. The deputies voted for this measure on March 17 as part of the Biodiversity Reconquest bill.

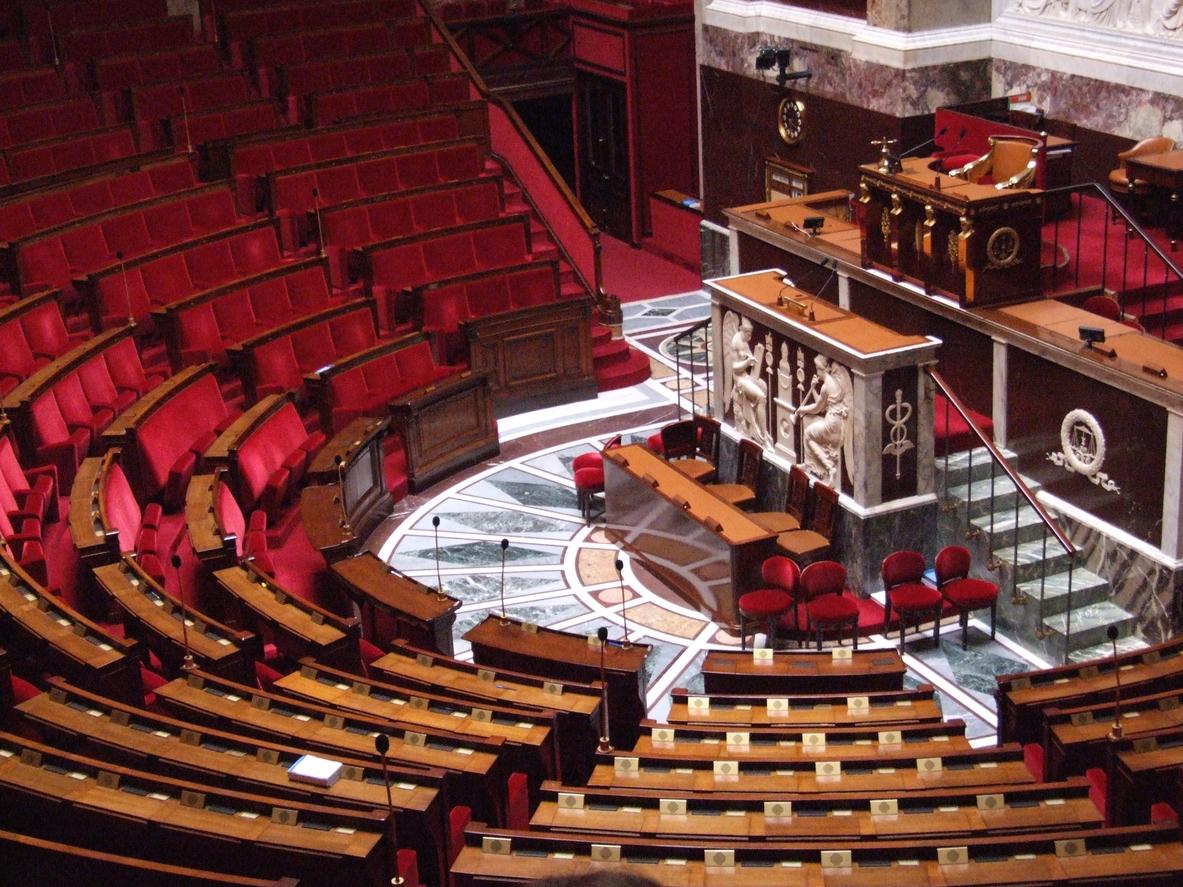

The Nutella tax is in the dark. This March 17, The national assembly has decided to reduce the contribution that should have been imposed on products containing palm oil. The amendment was debated within the framework of the Biodiversity Reconquest bill. If ecology was at the heart of the discussions, public health arguments emerged.

The nicknamed “Nutella tax” – because of the large amount of oil contained in this spread – consists of increasing the contribution imposed on products that contain palm oil. The Senate had adopted a significant increase: it should have gone from 300 euros per tonne in 2017 to 900 euros in 2020. But this initiative of environmentalists was not followed in the National Assembly. Instead, MPs chose to lighten the weight on palm oil. From now on, the surcharge will be 90 euros per tonne. The cash could even be exempt in the long term.

Cardiovascular risks

It is not for lack, for the ecologist deputy Laurence Abeille, to have defended the interest of such a taxation on several fronts. The senators “put forward public health” with such a measure, she explained to her elected colleagues. “Palm oil causes cardiovascular disease and poses real problems,” she added. “No more than pig fat,” retorted the now deputy David Douillet.

This assertion can be questioned. A study published in the BMJ in 2013 shows that taxing palm oil at 20% over a 10-year period in India reduced the number of deaths from myocardial infarction or stroke by 363,000. Indeed, this product contains a high rate of saturated fatty acids which promote the production of “bad” cholesterol.

But the alternative to palm oil is not necessarily more enviable. Raising the tax opens the possibility “that the agrifood industry replaces palm oil with hydrogenated oils, which are more dangerous, especially on the cardiovascular level,” said MP Razzy Hammadi.

.